Full-size SUV sales jumped 26% in the United States in the first-quarter of 2017, surging thanks to year-over-year gains from each of the seven nameplates in the category.

U.S. Vehicle Sales By Model - April 2017 YTDU.S. SUV/Crossover Sales By Model - March 2017 YTD

The Nissan Armada, up 156% thanks to the launch of a new model, added 4443 sales already this year. GM's quartet – Yukon, Yukon XL, Tahoe, Suburban – has added 6921 sales in early 2017.  |

| Click Chart To Expand |

Sales of the Ford Expedition, approaching the launch of an all-new 2018 Expedition, are up 44%, or 4769 units.

If this rate of growth continues throughout the course of 2017, Americans will buy and lease roughly 430,000 full-size, volume brand SUVs in calendar year 2017, nearly 90,000 more than last year.

You can click any model name in the tables below to find historical monthly and yearly U.S. auto sales data. You can also select a make and model at GCBC's Sales Stats page. This table is sortable, so you can rank large sport-utility vehicles any which way you like. Mobile users can now thumb across the table for full-width access. Suggestions on how GCBC should break down segments can be passed on through the Contact page.

Click Column Headers To Sort • February 2017 • March 2016 SUV | March

2017 | March

2016 | %

Change | 2017

YTD | 2016

YTD | %

Change |

| 3889 | 3825 | 1.7% | 13,445 | 10,679 | 25.9% |

| 9112 | 7658 | 19.0% | 22,653 | 20,351 | 11.3% |

| 5472 | 3834 | 42.7% | 15,442 | 10,673 | 44.7% |

| 3197 | 3394 | -5.8% | 9984 | 8985 | 11.1% |

| 2849 | 2427 | 17.4% | 7556 | 6702 | 12.7% |

| 3094 | 981 | 215% | 7291 | 2848 | 156% |

| 1112 | 1199 | -7.3% | 3437 | 3005 | 14.4% |

--- | --- | --- | --- | --- | --- | --- |

Total | 28,725 | 23,318 | 23.2% | 79,808 | 63,243 | 26.2% |

RECOMMENDED READINGLarge SUV Sales In America - February 2017Large SUV Sales In America - March 2016Top 20 Best-Selling SUVs In America - March 2017U.S. Auto Sales Brand Rankings - March 2017

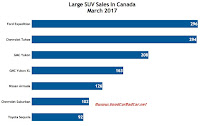

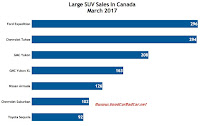

Canadian sales of full-size SUVs jumped 16% in March 2017, a record-setting March for the industry. After sales of these same seven large SUVs decreased marginally through the first one-sixth of 2017, first-quarter volume ended up rising 5% because of strength in March, led by the Ford Expedition and GM's short-wheelbase large SUVs.

Combined, the Chevrolet Tahoe and GMC Yukon owned 39% of the market. Combined, the Tahoe, Yukon, and their long-wheelbase siblings owned 60% of the market. Ford's long-wheelbase Expedition's sales figures are included by Ford in the Expedition total.  |

| Click Chart To Expand |

Nissan also reported a major increase in sales of the Armada, which reported an all-time annual high in Canadian sales last year and is expected to smash that record in 2017.

You can click any model name in the tables below to find historical monthly and yearly Canada auto sales data. You can also select a make and model at GCBC's Sales Stats page.

This table is sortable, so you can rank large sport-utility vehicles any which way you like. Mobile users can now thumb across the table for full-width access. Suggestions on how GCBC should break down segments can be passed on through the Contact page.

Click Column Headers To Sort • February 2017 • March 2016 SUV | March

2017 | March

2016 | %

Change | 2017

YTD | 2016

YTD | %

Change |

| 102 | 151 | -32.5% | 225 | 420 | -46.4% |

| 294 | 277 | 6.1% | 574 | 613 | -6.4% |

| 296 | 151 | 96.0% | 713 | 399 | 78.7% |

| 208 | 180 | 15.6% | 477 | 469 | 1.7% |

| 163 | 192 | -15.1% | 380 | 452 | -15.9% |

| 126 | 73 | 72.6% | 262 | 161 | 62.7% |

| 92 | 78 | 17.9% | 211 | 194 | 8.8% |

--- | --- | --- | --- | --- | --- | --- |

Total | 1281 | 1102 | 16.2% | 2842 | 2708 | 4.9% |

RECOMMENDED READINGLarge SUV Sales In Canada - February 2017Large SUV Sales In Canada - March 2016Canada Auto Sales Brand Rankings - March 2017Top 20 Best-Selling SUVs In Canada - March 2017

Remember 2016, when U.S. sales of full-size, volume brand SUVs jumped 22%?

U.S. Vehicle Sales By Model - February 2017 YTDU.S. SUV/Crossover Sales By Model - February 2017 YTD

In 2017's first two months, category-wide sales have grown 28% compared with the same period in 2016, surging because of improved demand for each and every nameplate.

GM's quartet is up 18% so far this year, as the segment controller increases volume far faster than the market at large but sees its market share fall from 74% at this time last year to 68% this year. |

| Click Chart To Expand |

In part, that market share decline at GM comes as Ford ramps up the Expedition clear-out in the lead-up to the fourth-generation Expedition's launch and as the second-generation Nissan Armada doubles its volume.

You can click any model name in the tables below to find historical monthly and yearly U.S. auto sales data. You can also select a make and model at GCBC's Sales Stats page.

This table is sortable, so you can rank large sport-utility vehicles any which way you like. Mobile users can now thumb across the table for full-width access. Suggestions on how GCBC should break down segments can be passed on through the Contact page.Click Column Headers To Sort • March 2017 • January 2017 • February 2016 SUV | Feb.

2017 | Feb.

2016 | %

Change | 2017

YTD | 2016

YTD | %

Change |

| 3922 | 3584 | 9.4% | 9556 | 6854 | 39.4% |

| 7660 | 6494 | 18.0% | 13,541 | 12,693 | 6.7% |

| 5906 | 3984 | 48.2% | 9970 | 6839 | 45.8% |

| 3707 | 3024 | 22.6% | 6787 | 5591 | 21.4% |

| 2629 | 2280 | 15.3% | 4707 | 4275 | 10.1% |

| 2289 | 1093 | 109% | 4197 | 1867 | 125% |

| 1179 | 954 | 23.6% | 2325 | 1806 | 28.7% |

--- | --- | --- | --- | --- | --- | --- |

Total | 27,292 | 21,413 | 27.5% | 51,083 | 39,925 | 27.9% |

RECOMMENDED READINGLarge SUV Sales In America - March 2017Large SUV Sales In America - January 2017Large SUV Sales In America - February 2016Top 20 Best-Selling SUVs In America - February 2017U.S. Auto Sales Brand Rankings - February 2017Midsize SUV Sales In America - February 2017

Canadian sales of full-size, volume brand SUVs jumped 50% in calendar year 2016. But matching that rapid rate of growth in the early part of 2017 has, at least through the end of February, proven impossible.

Canada Vehicle Sales Rankings By Model - February 2017 YTDCanada SUV/Crossover Sales By Model - February 2017 YTD

Despite Ford's clear-out of the outgoing Expedition as the automaker prepares to send the all-new fifth-generation Expedition to dealers – a clear-out that's resulted in a 68% year-over-year increase in 2017's first two months – the segment is down 3% this year, having grown by only four units in February.General Motors, the automaker that controls the category, is largely to blame. In January and February of 2016, GM Canada sold 1154 Suburbans, Tahoes, Yukons, and Yukon XLs, accounting for 72% of the segment's volume.  |

| Click Chart To Expand |

But in the same period this year, the GM quartet tumbled 23% to 889 units as GM's market share slid to 57%. Here's how you know there's been a shift: the Nissan Armada is outselling the Chevrolet Suburban.

Of course, the Suburban represents just one-quarter of the GM SUVs in this segment and only one-sixth of GM's full-size SUV portfolio.

Moreover, GM's deliveries in the segment hinge largely upon fleet sales, which fluctuate wildly from one season to the next. It's possible that the segment has flatlined. It's also possible that January and February are responsible for a small portion of the Canadian auto industry's annual results, and these results mean very little.

You can click any model name in the tables below to find historical monthly and yearly Canada auto sales data. You can also select a make and model at GCBC's Sales Stats page. This table is sortable, so you can rank large sport-utility vehicles any which way you like. Mobile users can now thumb across the table for full-width access. Suggestions on how GCBC should break down segments can be passed on through the Contact page.

Click Column Headers To Sort • January 2017 • February 2016 SUV | Feb.

2017 | Feb.

2016 | %

Change | 2017

YTD | 2016

YTD | %

Change |

| 69 | 123 | -43.9% | 123 | 269 | -54.3% |

| 172 | 208 | -17.3% | 280 | 336 | -16.7% |

| 218 | 137 | 59.1% | 417 | 248 | 68.1% |

| 160 | 152 | 5.3% | 269 | 289 | -6.9% |

| 137 | 131 | 4.6% | 217 | 260 | -16.5% |

| 74 | 61 | 21.3% | 136 | 88 | 54.5% |

| 54 | 68 | -20.6% | 119 | 116 | 2.6% |

--- | --- | --- | --- | --- | --- | --- |

Total | 884 | 880 | 0.5% | 1561 | 1606 | -2.8% |

RECOMMENDED READINGLarge SUV Sales In Canada - January 2017Large SUV Sales In Canada - February 2016Canada Auto Sales Brand Rankings - February 2017Top 20 Best-Selling SUVs In Canada - February 2017Midsize SUV Sales In Canada - February 2017

U.S. sales of full-size, volume brand, body-on-frame SUVs jumped 22% in calendar year 2016. Could that sort of growth continue? Indeed, it has.

U.S. Vehicle Sales Rankings By Model - October 2016 YTDU.S. SUV/Crossover Sales By Model - January 2017

January 2017 sales jumped 29%, year-over-year, to 23,791 units. Aside from a modest 5% downturn from the segment-leading Chevrolet Tahoe, every nameplate in the category posted meaningful improvements in January.

|

| Click Chart To Expand |

The new Nissan Armada more than doubled its volume. The Tahoe's 318-unit decline was more than offset by the Chevrolet Suburban's 2364-unit uptick.

General Motors owned 70% of the segment's sales in January 2017, down from 76% in January 2016.

You can click any model name in the tables below to find historical monthly and yearly U.S. auto sales data. You can also select a make and model at GCBC's Sales Stats page. This table is sortable, so you can rank large sport-utility vehicles any which way you like. Mobile users can now thumb across the table for full-width access. Suggestions on how GCBC should break down segments can be passed on through the Contact page.

Click Column Headers To Sort • February 2017 • December 2016 • January 2016

SUV | Jan.

2017 | Jan.

2016 | %

Change | 2017

YTD | 2016

YTD | %

Change |

| 5634 | 3270 | 72.3% | 5634 | 3270 | 72.3% |

| 5881 | 6199 | -5.1% | 5881 | 6199 | -5.1% |

| 4064 | 2855 | 42.3% | 4064 | 2855 | 42.3% |

| 3080 | 2567 | 20.0% | 3080 | 2567 | 20.0% |

| 2078 | 1995 | 4.2% | 2078 | 1995 | 4.2% |

| 1908 | 774 | 147% | 1908 | 774 | 147% |

| 1146 | 852 | 34.5% | 1146 | 852 | 34.5% |

--- | --- | --- | --- | --- | --- | --- |

Total | 23,791 | 18,512 | 28.5% | 23,791 | 18,512 | 28.5% |

RECOMMENDED READING

January has traditionally been an exceptionally low-volume month for full-size SUVs in Canada. As a result, the fact that sales slid 7% – despite growth in the market at large – in January 2017 is not likely a sign that full-size SUV sales will fall 7% in calendar year 2017.

Canada SUV/Crossover Sales By Model - January 2017Canada Vehicle Sales Rankings By Model - January 2017

They may. But January is not an accurate predictor of any outcome. Only 4.5% of the full-size, volume brand, truck-based, body-on-frame SUVs sold in Canada in 2016 were sold in January, a period that accounts for 8.5% of the calendar.  |

| Click Chart To Expand |

Regardless, after dominating the category throughout 2016, GM's quartet stumbled in January 2017 as Ford, Nissan, and Toyota produced meaningful improvements with the Expedition, Armada, and Sequoia, respectively.

Still, more than half the market went GM's way, but Chevrolet/GMC full-size SUV volume slid 35%.

In 2016, GM owned 68% of the category. In January 2016, specifically, GM Canada owned 74% of the category.

The top-selling Ford Expedition's 199 total January 2017 sales represented a 79% year-over-year increase.

You can click any model name in the tables below to find historical monthly and yearly Canada auto sales data. You can also select a make and model at GCBC's Sales Stats page. This table is sortable, so you can rank large sport-utility vehicles any which way you like. Mobile users can now thumb across the table for full-width access. Suggestions on how GCBC should break down segments can be passed on through the Contact page.

Click Column Headers To Sort • February 2017 • December 2016 • January 2016 SUV | Jan.

2017 | Jan.

2016 | %

Change | 2017

YTD | 2016

YTD | %

Change |

| 54 | 146 | -63.0% | 54 | 146 | -63.0% |

| 108 | 128 | -15.6% | 108 | 128 | -15.6% |

| 199 | 111 | 79.3% | 199 | 111 | 79.3% |

| 109 | 137 | -20.4% | 109 | 137 | -20.4% |

| 80 | 129 | -38.0% | 80 | 129 | -38.0% |

| 62 | 27 | 130% | 62 | 27 | 130% |

| 65 | 48 | 35.4% | 65 | 48 | 35.4% |

--- | --- | --- | --- | --- |

|

|

Total | 677 | 726 | -6.7% | 677 | 726 | -6.7% |

RECOMMENDED READINGLarge SUV Sales In Canada - February 2017Large SUV Sales In Canada - December 2016Large SUV Sales In Canada - January 2016Canada Auto Sales Brand Rankings - January 2017Top 20 Best-Selling SUVs In Canada - January 2017Midsize SUV Sales In Canada - January 2016